vermont state tax brackets

Income tax brackets are required state taxes in. Detailed Vermont state income tax rates and brackets are available on this page.

2022 Property Taxes By State Report Propertyshark

The state of Vermont has a Corporate Tax rate with three 3 tax brackets.

. Vermonts 2022 income tax ranges from 335 to 875. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Vermont also has a 600 percent to 85 percent corporate income tax rate.

These income tax brackets and rates apply to. Before sharing sensitive information make sure youre on a state government site. The site is secure.

Corporate Tax is only. So for single taxpayers. In addition check out your federal tax.

The Vermont Single filing status tax brackets are shown in the table below. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. This page has the latest Vermont brackets and tax rates plus a Vermont income tax calculator.

Vermont based on relative income and earningsVermont state income taxes are listed below. The site is secure. State government websites often end in gov or mil.

Vermont Tax Brackets for Tax Year 2020. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66. State government websites often end in gov or mil.

Rates range from 335 to. The major types of local taxes collected in Vermont include income property and sales taxes. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income.

Income tax tables and other tax. Vermont also has a 600 percent to 85 percent corporate income tax rate. 355 on the first 37450 of taxable income.

Before sharing sensitive information make sure youre on a state government site. 660 on taxable income. Box 547 Montpelier VT 05601-0547 Emailtaxbusinessvermontgov Phone.

The latest Vermont state income tax brackets table for the Married Filing Jointly filing status is shown in the table below. State government websites often end in gov or mil. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets.

Before sharing sensitive information make sure youre on a state government site. The highest tax bracket starts at only 25000. It ranges from 600 to 850.

Vermonts income tax rates are assessed over 5 tax brackets. Vermont Income Tax Rate 2020 - 2021. 335 on the first 38700 of taxable income.

68 on taxable income between 37451 and 90750. Vermont Income Taxes. These taxes are collected to provide essential state functions resources and programs to.

As you can see your Vermont income is taxed at different rates within the given tax brackets. In marginal tax systems the tax rate applies to each portion of income with a given bracket. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020.

Any income over 204000 and 248350 for. State of Vermont Department of Taxes Taxpayer Services Division PO. The Vermont State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Vermont State Tax CalculatorWe also provide.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. The site is secure.

Vermont Tax Forms And Instructions For 2021 Form In 111

Utah Income Tax Rate And Brackets 2019

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Property Tax Rates Nancy Jenkins Real Estate

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

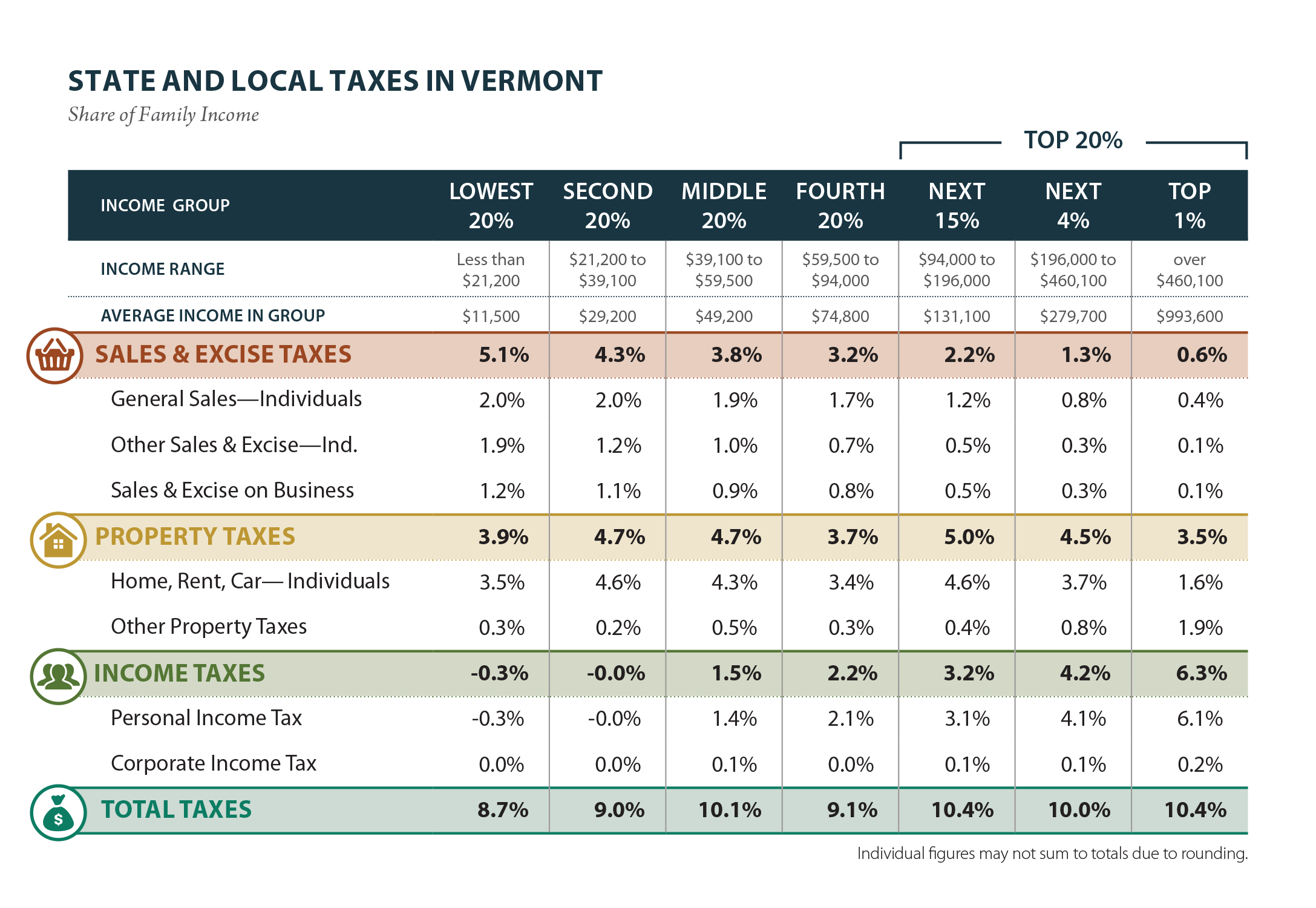

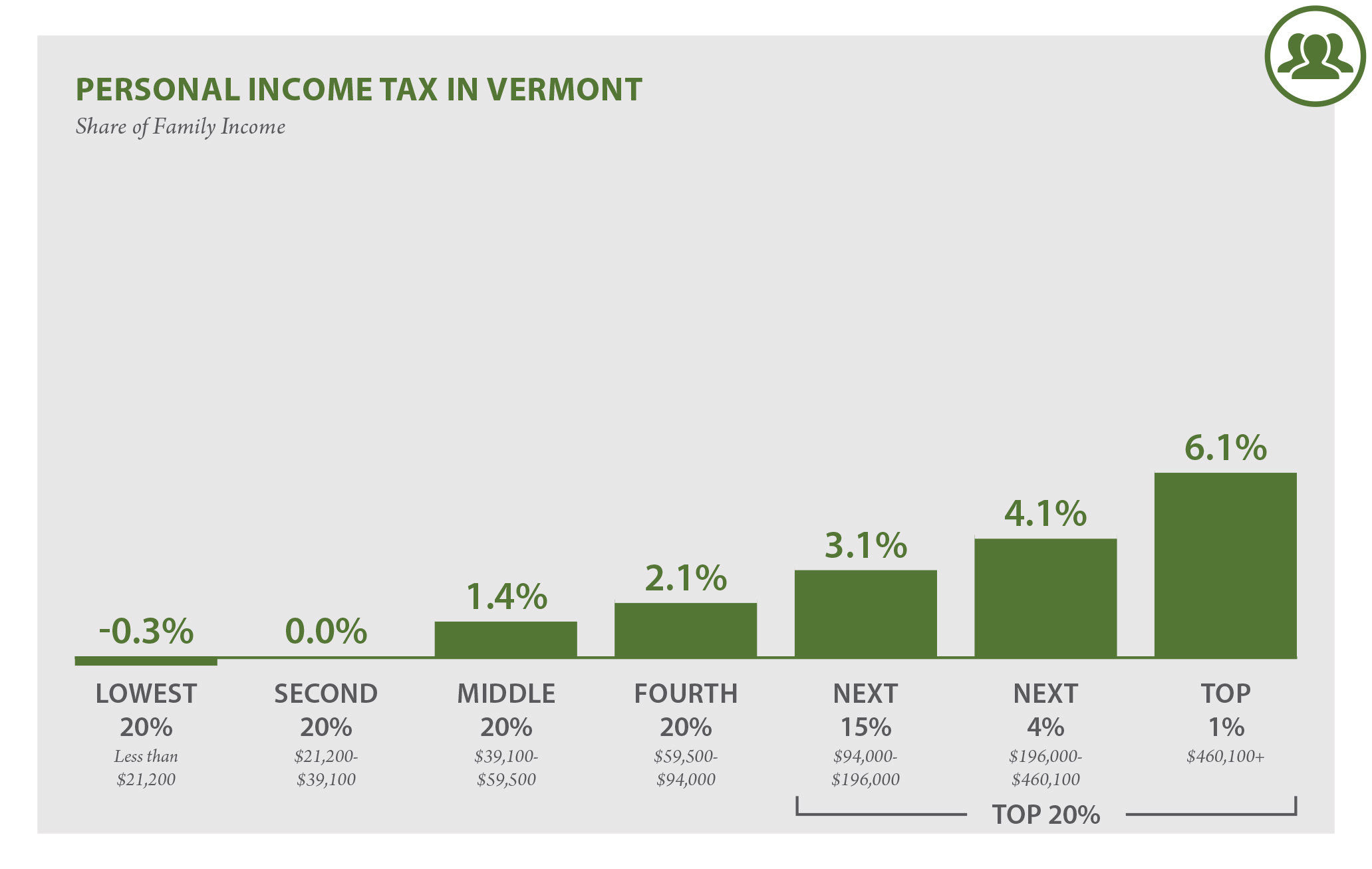

Vermont Who Pays 6th Edition Itep

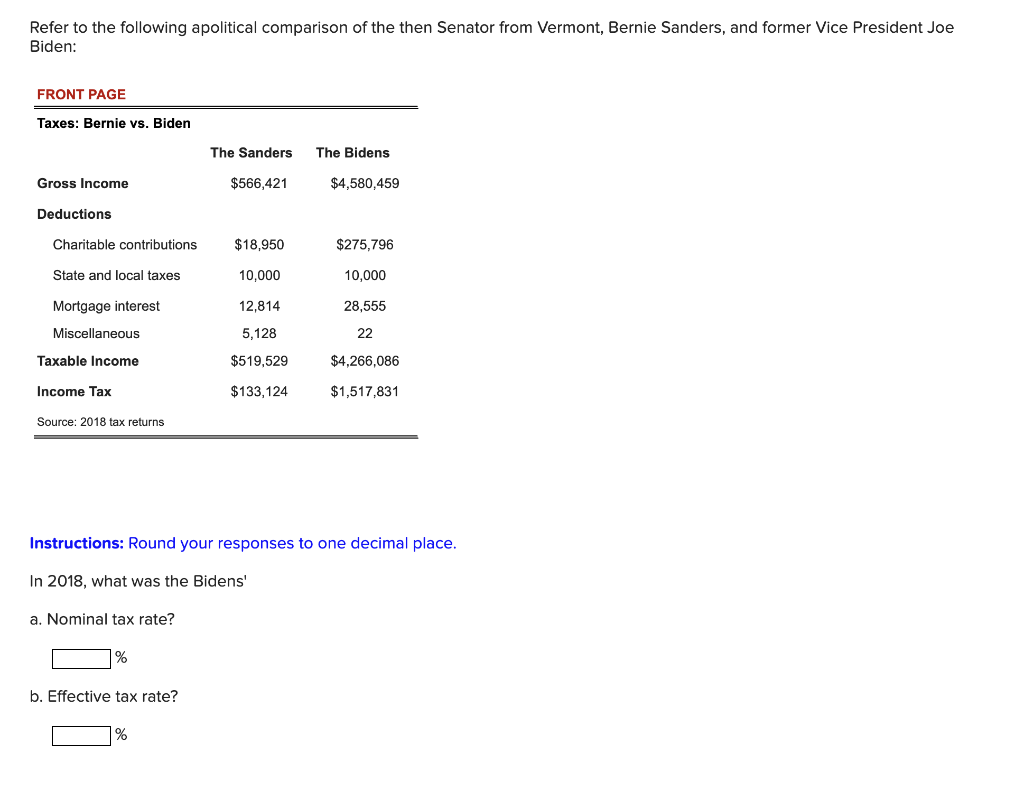

Solved Refer To The Following Apolitical Comparison Of The Chegg Com

Learn More About The Massachusetts State Tax Rate H R Block

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Vermont Sales Tax Rate Table Woosalestax Com

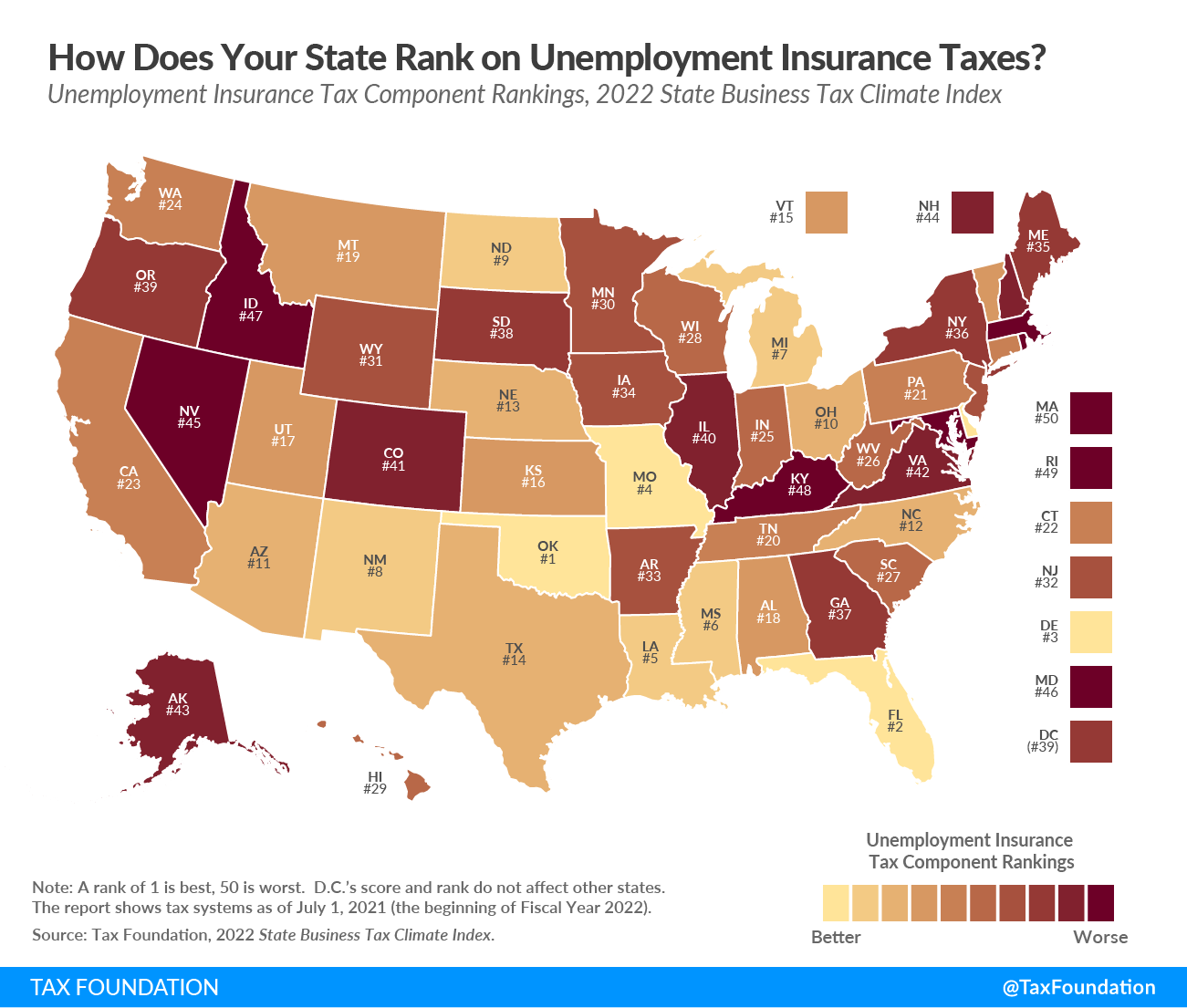

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Who Pays 6th Edition Itep

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge

Vermont State Tax Tables 2022 Us Icalculator

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute