does new mexico tax pensions and social security

Up to 20000 exclusion for pension annuity or Def. Today New Mexico is one of only 13 states that tax Social Security benefits.

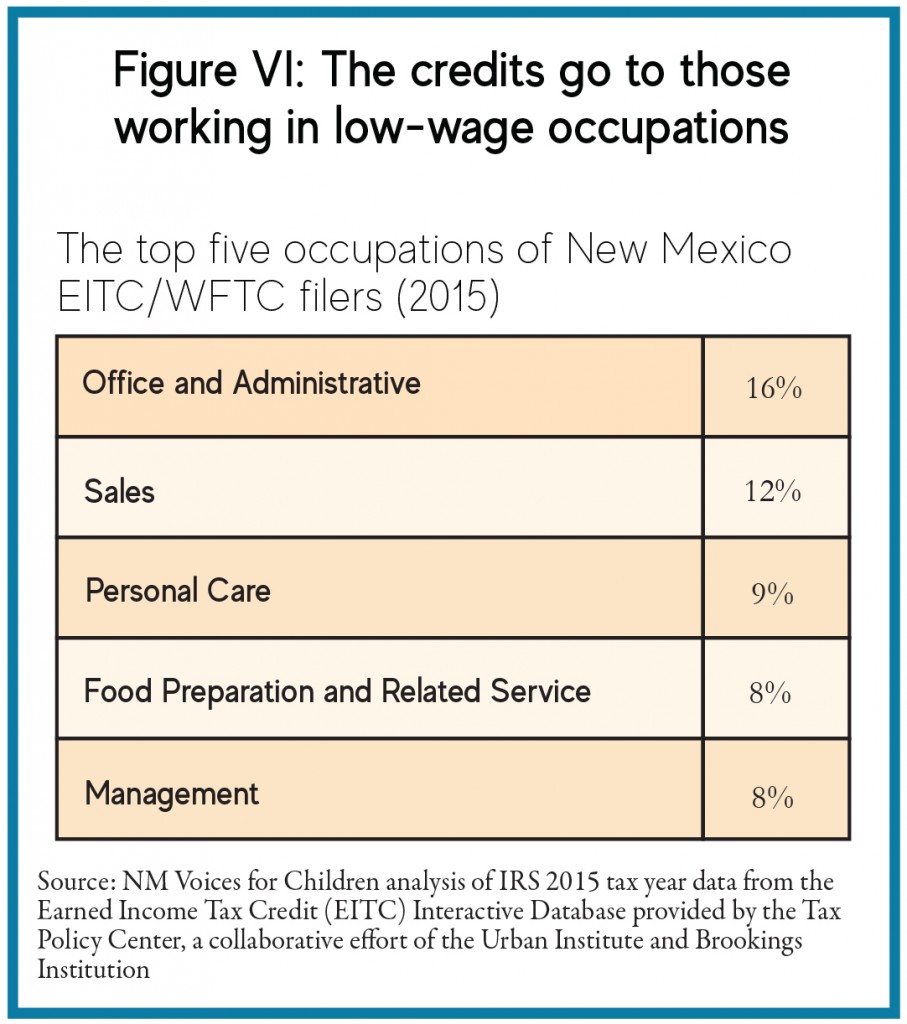

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

The exemption is available to single taxpayers with less than 100000.

. A ninth state New Hampshire only taxes. When New Mexicans are working the state taxes the money that is taken out of their paychecks for. The good news however is that most states dont tax Social Security benefits.

Tax relief from the new Social Security exemption is expected to total 841 million in the first year. Social Security Benefits. While the new action will exempt many seniors from paying taxes it does not exempt everyone.

For 2022 theres a flat 5 tax on interest and. Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. 52 rows Retirement income and Social Security not taxable.

Colorado Connecticut Kansas Minnesota Missouri Montana. Social Security benefits will still be taxed for beneficiaries in New Mexico who earn more than 100000 each year. Same goes for Social Security benefits.

The bill includes a cap for exemption eligibility of 100000 for single. Eight states Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming dont tax income at all. IRS for tax year 2017 and using a guesstimate of the average New Mexico tax rate faced by New Mexico recipients of taxable.

Ad Move Your Plan Towards Full Funding. There are just 13 states that do. New Mexicos income tax piggybacks on the federal.

New Mexicos tax on Social Security benefits is a double tax on individuals. Yes Deduct public pension up to 37720 or. However many lower-income seniors can qualify.

North Dakota on the other hand entirely eliminated the taxation on Social. New Mexico taxes Social Security income although there is a deduction available for low-income taxpayers 65 or older of up to 8000. No New Hampshire tax on them.

Its important to note that New Mexico does tax retirement income including Social Security. Retirement Income Is Taxed. Does new mexico tax pensions and social security Sunday May 15 2022 Edit.

New Mexico on Tuesday joined a growing number of states that have reduced or eliminated taxes on Social Security benefits. Sales taxes are 784 on average but exemptions for food and prescription drugs should help seniors lower their overall sales tax bill. It allows individuals aged 65 and over with a GDI of 51000 or less for married couples and 28500.

The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year. New Mexicos Taxation of Social Security Benefits. There are more than 300000 retirees in New Mexico.

Democrats said that if Social Security. But the tax will be eliminated for those who earn less thanks to. Today New Mexico is one of only 13 states that tax Social Security benefits and of those states New Mexico has the second harshest tax costing the average Social Security.

Is Social Security taxable in New Mexico. In particular New Mexico base income starts with federal adjusted gross income. February 12 2022 By.

The tax costs the average New Mexico senior nearly 700 a year. Michelle Lujan Grisham a Democrat signed. Does New Mexico Tax Pensions and Social Security.

Pin On Data Usage Farming Dairy Production

Where S My Refund New Mexico H R Block

New Mexico May Limit Or Scrap Tax On Social Security Income New Mexico News Us News

New Mexico Retirement Tax Friendliness Smartasset

Social Security Income Tax Exemption Taxation And Revenue New Mexico

Guide To New Mexico Disability Benefits

Special Relief Lawmakers Approve 500 Payments To New Mexicans Source New Mexico

The Most Tax Friendly States To Retire Cheyenne Wyoming Wyoming Best Cities

Social Security Income Tax Exemption Taxation And Revenue New Mexico

6 Pros And Cons Of Retiring In New Mexico 2020 Aging Greatly

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

The 37 States That Don T Tax Social Security Benefits The Motley Fool Tax Refund Social Security Benefits Income

New Mexico Estate Tax Everything You Need To Know Smartasset

New Mexico Passes Legislation Including Social Security Tax Cuts Child Tax Credit And Tax Rebates Up To 500 Gobankingrates

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

The Best States For An Early Retirement Early Retirement Health Insurance Life Insurance Facts

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Tax Rebate 2022 How To Claim The New 500 Checks Marca